Introduction: Bitcoin vs Ethereum – The 2025 Dilemma

In 2025, the cryptocurrency market is expected to stay interesting to global investors, mainly due to Bitcoin (BTC) and Ethereum (ETH). With many changes and investments driving the crypto market, a key question for those interested is: Should you opt for Bitcoin or Ethereum this year?

Different uses and blockchain networks do not stop both from remaining the top two cryptocurrencies by market size. The following article will compare Bitcoin and Ethereum in detail by looking at their price changes, technology, possibilities for investors and potential risks. If you’re an expert or just beginning, this document will assist with your decision making in 2025.

Overview of Bitcoin: Price and Potential in 2025

Among all virtual currencies, Bitcoin remains the most widely recognized. Bitcoin appeared in 2009 under the name of Satoshi Nakamoto, who made it as a peer-to-peer replacement for government-controlled fiat currencies. Through the years, Bitcoin has come to be seen as “digital gold” because it resists inflation and influence from the government.

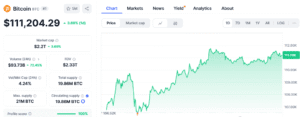

BTC Price Trends (2025):

Following the crypto winter of 2022, BTC prices have improved a lot. The 2024 BTC halving dropped miner rewards to 3.125 BTC from 6.25 BTC, making BTC’s supply scarcer and promoting a rise in the market. After every halving, Bitcoin rises in price around 6 to 12 months later. Between early 2025 and the end of the year, some experts expect BTC will see a rise from $55,000 to $70,000.

BTC Adoption & Use Case:

Storing value is BTC’s primary reason for being. These days, cryptocurrencies are kept in company treasuries, invested by those saving for retirement and legally accepted as money in various jurisdictions (such as El Salvador). BlackRock and Fidelity are just two of the major financial institutions that have introduced Bitcoin ETFs for easier purchase by both individual and business investors.

Advances in both Networks and Technologies:

BTC’s major network is still steady and the Lightning Network allows people to make cheaper and faster transactions. Even though it may not be as versatile as Ethereum for deploying smart contracts, BTC’s reliability and simplicity are what attracts users over time.

Pros:

- There are just 21 million BTC in existence.

- Reliable network security

- Acceptance and routine commitment to data service institutions

Cons:

- Limited programmability

- It is slow to send and receive payments if we do not use Lightning.

- This system uses a lot of energy.

Overview of Ethereum: Price and Potential in 2025

Thanks to Vitalik Buterin, Ethereum was designed in 2015 as a platform for smart contracts, allowing for dApps, DeFi, NFTs and similar tools. Bitcoin has moved past being a cryptocurrency and now consists of a broad ecosystem.

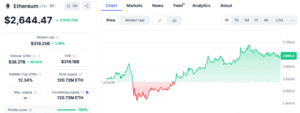

Ethereum Price Trends (2024-2025):

Ethereum began 2025 priced between $3,200 and $4,000, with 2024 recognized for the growth of its ecosystem and rising activity around DeFi and NFTs. If there is a rise in involvement by both institutions and retail investors, ETH could climb to $6,000 to $8,000.

Ethereum 2.0 and Network Improvements:

Ethereum completed the shift from Proof of Work (PoW) to Proof of Stake (PoS) in 2022, called the Merge. Since that time, Ethereum has used less energy, boosted its scale and incorporated sharding. Such advancements are essential for many people to use cryptocurrency and to see their transaction fees lowered.

Use Case and Developer Activity:

Ethereum is the main platform where decentralized applications are built. Many people create on Ethereum each day which makes it the blockchain with the most active development. Uniswap, Aave and MakerDAO are powered by Ethereum.

Pros:

- A large number of developers work with Flutter.

- Application in DeFi, NFTs and DAO fields.

- PoS helps to protect the environment.

Cons:

- The supply increasing caused by inflation (even if now lessened by EIP-1559)

- More complexity and more areas to target

- Scaling continues to be a problem.

Key Differences Between Bitcoin and Ethereum:

1. Technology & Consensus Mechanism

- In BTC, the PoW process adds high protection, but it’s also very energy-consuming.

- Using Proof of Stake (PoS), Ethereum blockchain has become both energy-saving and capable of growing to meet demand.

2. Supply and Inflation

- BTC only has 21 million coins; the supply is meant to contract over time.

- Ethereum does not have a hard cap, but the loss of 90 percent of some fees after EIP-1559 and the transition to PoS have reduced the overall amount issued.

3. Use Case

- Mainly, people exchange and store their value through BTC.

- Ethereum was created for the purpose of smart contracts and decentralized applications.

4. Adoption & Institutional Support

- BTC is becoming more popular and some nations have declared it a recognized form of money.

- Ethereum leads the way in the world of developers and dApps.

5. Network Upgrades

- BTC continues to be stable even as the changes are kept to a minimum.

- Ethereum keeps advancing with common updates like The Surge, The Scourge and further ones in the future.

Investment Outlook for 2025: Which Is the Better Buy?

Each blockchain BTC and ETH contains its own advantages and disadvantages. Let’s look at how their 2025 outlook could affect investors.

1. Risk and Volatility

- Because of its stable supply and interest from institutions, BTC is less likely to be very unstable.

- Because of Ethereum’s many practical uses, it can offer investors the chance to gain more than Bitcoin.

2. Long-term Potential

- Like gold, BTC is regularly called a safe-haven asset.

- Like investing in technology companies, Ethereum provides a way to back the infrastructure being created for the web of tomorrow.

3. Market Capitalization & Liquidity

- In early 2025, BTC is valued in the market at close to $1.3 trillion.

- Thanks to growing activity and more projects on the blockchain, Ethereum’s supply has increased to $650 billion.

4. Institutional Interest

- Money is flowing into Bitcoin ETFs at a huge level.

- Not only is Ethereum’s Coinbase a success, but fintech leaders such as Kraken, Robinhood and others have started offering ETH staking too.

5. Expert Opinions

- If institutional adoption of BTC moves quickly, Ark Invest predicts that it might cost more than $1 million in the next decade.

- Both VanEck and JP Morgan see Ethereum’s value rising above BTC ‘s should DeFi adoption rise.

6. Diversification Strategy

A lot of investors believe the smartest way is to add both BTC and Ethereum to their crypto holdings.

I think security and lower risk are best achieved by holding 60% of my savings in Bitcoin.

About 40% of your portfolio should go to Ethereum for exposure to both growing and useful projects.

Historical Performance Comparison: Bitcoin vs Ethereum (2015–2025)

Over the years, BTC and Ethereum have soared among cryptocurrencies and created their own paths of growth. A history of their previous results can indicate their likely long-term outcome and their level of risk.

Long before Ethereum came along, BTC had earned the title of best crypto asset in 2009. By 2015, a BTC cost about $300, but just six years later, it reached over $69,000, a gain of over 22,000%. Accidents in 2018 and 2022 didn’t weaken BTC and let it maintain its significance as a long-term store of value.

Ethereum was unveiled in the middle of 2015 when it traded for less than $1. At the close of 2021, ETH was worth over $4,800, giving investors more than 400,000% return. Ethereum’s results may fluctuate more than BTC , but the growth caused by its involvement with smart contracts, DeFi and NFTs has often made its returns greater.

Between 2015 and 2025, Ethereum has typically recorded higher growth rates than BTC , while BTC has remained the most stable in market capitalization and gained backing from large companies. Many investors interested in the huge potential of Ethereum tend to choose it over BTC which some value for being predictable and scarce.

All things considered, BTC has been more stable and supplies gains much like keeping your money safe, while Ethereum has grown fast due to new technology. Every coin’s behavior in the past tells us what it means for the developing crypto market.

Expert Predictions: What Analysts Are Saying About Bitcoin and Ethereum:

Analysts and cryptocurrency experts look ahead to 2025 and offer a blend of objective views and experimental predictions about BTC and ETH.

Most people consider BTC to be the digital gold among all cryptocurrencies. According to Cathie Wood, CEO of ARK Invest, BTC might be worth between $500,000 and $1 million in the next decade. She believes this because Bitcoin could be used by many as a global tool to protect against inflation. Seeing BTC as a good option, many big investors are buying it, reinforcing its stability.

Besides, Ethereum’s adaptability and well-developed environment are the main drivers of its forecast. Tim Draper, an investor in emerging markets, believes Ethereum could reach $10,000 soon because of its powerful positions in DeFi and NFTs. Since Ethereum changed to Proof of Stake (PoS) and is introducing ETH 2.0 updates, Vitalik Buterin (Ethereum’s co-founder) is optimistic Ethereum could take on a major role in powering global decentralized apps.

Analysts have found that although their uses in the market are different, BTC and Ethereum will gain from more institutional focuses, stricter global rules and wider acceptance in 2025. The improvements Ethereum has made in scalability and expanding its use cases may let it compete with BTC, as BTC’s continued price rise continues to bring in new investors.

To check the price of BTC and ETH in real time check CoinMarketCap or Coingecko.

For More financial News and ways to earn money visit our blog section.